What to Do If Your House Gets Damaged by a Storm

Dealing with the aftermath of a storm-damaged house can be overwhelming, but knowing the right steps to take can make a significant difference. From assessing the extent of the damage to contacting your insurance provider for suitable accommodations while your home is being repaired, navigating this process requires attention to detail and prompt action. In this comprehensive guide, we will provide you with valuable information and expert advice on how to handle a situation where your house has been impacted by a storm, ensuring you are well-informed and prepared during this challenging time.

First Thing’s First – Safety

Remember that the safety and well-being of you and your loved ones is the number one priority in the event of a storm. Before anything else, ensure that yourself, your family, and your pets are safe, and if possible, secure essential documents or photos that might be irreplaceable.

Personal Safety

In the aftermath of a storm, the physical safety of yourself and others should be the top concern. Keep the following points in mind:

Avoid stepping on or touching downed power lines and objects they are touching, as they may be electrified.

Make sure everyone is accounted for and safe.

Keep a safe distance from damaged structures as they could collapse.

Avoid driving on flooded roads. Water may be deeper than it appears, and vehicles can easily be carried away in just two feet of water.

Document Safety

Once personal safety has been assured, if possible, try to retrieve and protect key documents and cherished items:

Gather important documents such as passports, birth certificates, insurance policies, and property deeds.

If time allows, collect cherished photographs or personal items that cannot be replaced.

Place these items in a waterproof container or zip-top bag to protect against potential water damage.

Remember, items and properties can be replaced, but lives cannot. Prioritize safety above all else in severe weather situations. Call your local authorities or emergency services if you are in immediate danger or if your home environment is unsafe due to storm damage.

Assessing the Damage

Understanding the Extent of Storm Damage

Before you can proceed with repairs or contact your insurance, it’s crucial to understand the full extent of the storm’s damage. Start by visually inspecting your property, taking note of any apparent structural damage, such as broken windows, damaged roofing, or fallen trees. Remember to prioritize safety and avoid areas with a risk of collapse or electrical hazards.

It is important to document this damage thoroughly. Take photos or videos of all affected areas, capturing the details necessary for insurance claims. This initial assessment will help you communicate effectively with contractors and insurance representatives, setting the stage for a more accurate and efficient restoration process.

Next, consider having a professional inspector assess the damage. They can provide an expert perspective on hidden issues, such as water damage or potential mold growth, which may not be immediately apparent.

Identifying Unsafe Areas

After a storm, some areas of your home may be unsafe to enter. It’s essential to identify these places to prevent injury. Look for signs of structural damage like cracks in the walls or ceilings, sagging floors, or leaning walls. Be cautious of water damage, as soaked materials can collapse under weight.

Check for exposed wires, broken gas lines, or electrical hazards that could pose immediate danger. If you smell gas or hear hissing noises, leave the area immediately and contact emergency services.

Never enter a flooded basement or a room with standing water if the electricity is on, as there could be a risk of electrocution. If you’re unsure about the safety of any part of your home, it’s best to wait for a professional to conduct a thorough inspection. Their expertise ensures that all unsafe areas are marked and addressed properly before any repair work begins.

Navigating Insurance Claims

Contacting Your Insurance Provider

Once you’ve documented the damage, the next step is to contact your insurance provider. Do this as soon as possible because promptness can be crucial in claims processes. Have your policy number and relevant documentation on hand when you call. Be prepared to provide a general description of the damage and answer any initial questions they might have.

Your insurance company will likely send an adjuster to assess the damage in person. It’s a good idea to be present during this inspection so you can ensure that the adjuster notes all the damage you’ve observed. Also, this is the time to discuss temporary accommodations if your home is uninhabitable. Most insurance policies cover the cost of living elsewhere while your home is being repaired.

Keep a record of all interactions with your insurance company, including phone calls, emails, and in-person meetings. Staying organized can help streamline your claim and ensure you receive the compensation you’re entitled to in a timely manner.

Understanding Your Coverage

Understanding what your insurance policy covers is vital before you can file a claim for storm damage. Policies can vary significantly, and not all types of damage may be included. Review your policy to check for coverage specifics, such as damage from wind, rain, or fallen trees. Be aware of any exclusions that might affect your claim.

Pay attention to your deductible—the amount you’re responsible for paying out-of-pocket before your insurance coverage kicks in. Knowing this figure will help you plan financially for the repair process.

If you have questions or something in your policy isn’t clear, don’t hesitate to reach out to your insurance provider for clarification. Understanding your coverage in detail can prevent surprises down the line and ensure you’re fully aware of the benefits you’re entitled to under your policy.

Understanding your insurance coverage comprehensively will help you make informed decisions about repairs and advocate for yourself throughout the claims process.

Finding Temporary Accommodations

Evaluating Your Accommodation Needs

If your home is too damaged to live in, you’ll need to find temporary accommodations. Start by evaluating your needs. Consider the size of your family, the length of time you’ll be displaced, and any special requirements, such as accessibility needs or pet-friendly environments.

Your insurance policy may cover temporary housing costs, so review your policy or speak with your insurance provider to understand the extent of your coverage. This may include hotels, rental homes, or furnished apartments. Ensure your accommodations are within a reasonable distance from your home and workplace to minimize disruption to your daily routine.

Keep records and receipts of all accommodation expenses. Even if you’re unsure whether your insurance will cover them, accurate records will support your claims and ensure that you’re reimbursed for any out-of-pocket expenses.

Finding the right temporary home can provide stability and comfort during the often lengthy process of home repair and restoration.

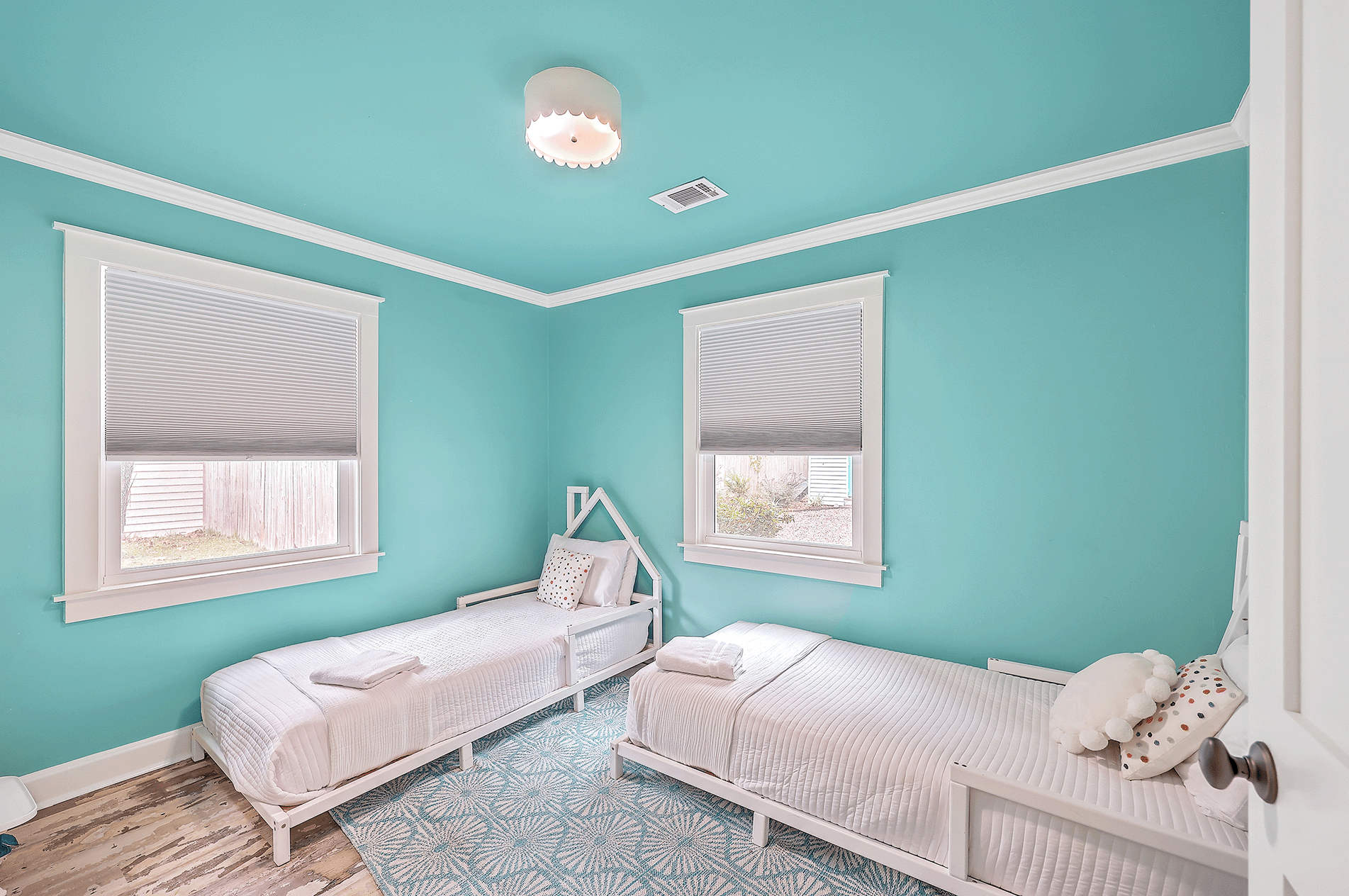

Selecting the Right Temporary Home

Choosing the right temporary home is a balance between comfort and convenience. When selecting a place to stay, consider the location relative to your work, your children’s schools, and essential services. A good temporary home should help maintain your family’s routine as much as possible.

Look into the amenities provided. Access to a full kitchen can help save on food costs and maintain normalcy. In-home laundry facilities are also essential for longer stays. If you’re in a furnished rental, check what’s included in the package—furniture, housewares, linens, and utilities.

Look for temporary housing providers like, CorpComfort, who offer flexible lease terms, as the rebuilding process can often be delayed by contractors or insurance companies.

Remember, the right temporary home can significantly reduce the stress of displacement, so take the time to find a place that meets your needs. Ensure that your insurance company places you in a home similar to yours in convenience and comfort. If you’re unsure what your options are, or if your insurance company is being fair during this stressful time, call us.